Key information

The DJE - Gold & Ressourcen is a thematic global equity fund. The concentrated portfolio of 50-70 stocks focuses on companies in the mining, processing and marketing of gold. Equities from the broader commodities universe, such as diversified mining companies, non-ferrous metals, oil and gas, can also be added for further diversification. The investment strategy is completely independent from any benchmark requirements and the share of gold mining stocks can vary between 30 and 100%. With gold as the investment focus, the fund offers diversification and a lower correlation to traditional investment strategies.

Responsible manager since 30/06/2008

Key information

| ISIN: | LU0159550077 |

| WKN: | 164323 |

| Category: | Fund Sector Equity Precious Metals |

| Minimum Equity: | 51% |

| Partial Exemption of Income ¹: | 30% |

| VG/KVG: | DJE Investment S.A. |

| Fund Manager: | DJE Kapital AG |

| Risk Category: | 5 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 27/01/2003 |

| Fund currency: | EUR |

| Fund Size (18/04/2024): | 79,10 Mio EUR |

| TER p.a. (29/12/2023): | 1,95% |

| Reference Index: | - |

Fees

| Initial Charge: | 5,000% |

| Management Fee p.a.: | 1,670% |

| Custodian Fee p.a.: | 0,060% |

|

Performance Fee p.a.: 10% of the [Hurdle: exceeding 6% p.a.] unit value performance, provided the unit value at the end of the settlement period is higher than the highest unit value at the end of the previous settlement periods of the last 5 years [High Water Mark Principle]. The settlement period begins on 1 January and ends on 31 December of a calendar year. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (18/04/2024)

| Morningstar*: |

|

|

Awards: Alternative Investment Award Austria 2024 1st place in the category "Equity Funds Precious Metals" €uro Fund Award 2023 1st place over 1 year and 3rd place over 10 years in the category "Equity Funds Gold" Mountain View Fund Awards 2023 1st place - Equity Funds Sector Precious Metals |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | AA |

| ESG-Qualityrating (0-10): | 7,410 |

| Environment Rating (0-10): | 4,347 |

| Social Rating (0-10): | 5,930 |

| Governance-Rating(0-10): | 6,700 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 95,620% |

| Peergroup: |

Equity Sector Materials

(137 Fonds) |

| Coverage rate ESG rating: | 93,238% |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 476,426 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (18/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 21,62% |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -14,03% |

| Maximum Drawdown (1 year): | -17,34% |

| Sharpe Ratio (2 years): | -0,21 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/03/2024

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| Canada | 26,88% |

| United States | 16,12% |

| United Kingdom | 15,77% |

| Australia | 8,43% |

| South Africa | 5,19% |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Stocks | 91,53% |

| Bonds | 6,93% |

| Cash | 1,54% |

Investment strategy

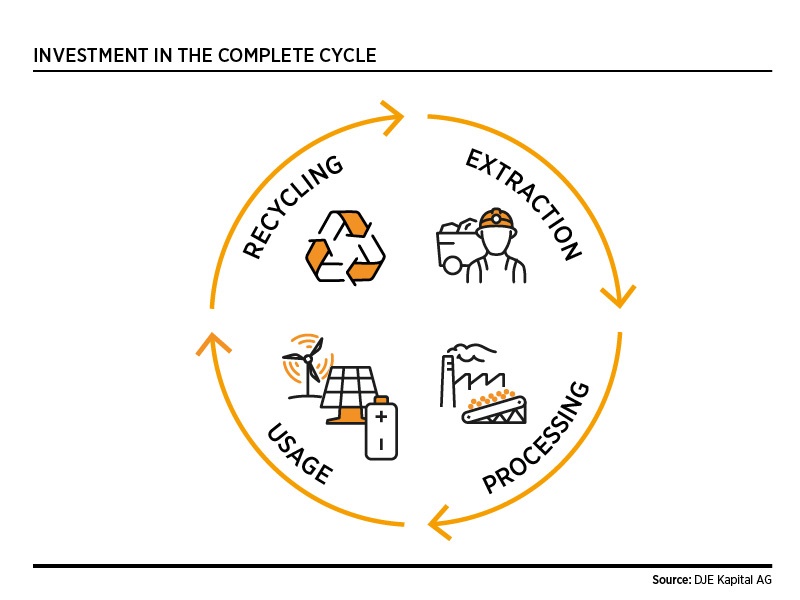

The thematic and globally investing equity fund focuses on gold and precious metals, diversified commodity groups, base metal producers, chemical companies and oil & gas producers. The fund pursues a bottom-up approach with high-quality stock selection, focusing on the fundamental key financial indicators of the companies. We invest primarily in gold producers with a competitive cost structure that generate free cash flows even at lower gold prices. In general, negative or falling real interest rates are positive for tangible assets, particularly gold. Demand for gold is likely to rise if real interest rates are low or fall.

Chances

- Exchange rate gains in global investments are possible

- In the long term, high upside potential for stocks of the gold and commodity sector

- Increasing demand for physical gold due to declining confidence in established currencies and high demand from the emerging market jewelery sector; this should lead to higher gold prices and thus to higher prices for gold mining stocks

Risks

- Shares in the commodity and precious metals sector are generally more volatile than the overall market

- Currency risks resulting from a high proportion of foreign investments

- In addition to market price risks (equity and currency risks), there are country and credit risks

Target group

Der Fonds eignet sich für Anleger

- who wish to minimise risk in comparison to direct investment in individual stocks in the gold and commodities sectors

- with a longer-term investment horizon

- who seek to focus their equity investments on gold producers and commodity stocks

Der Fonds eignet sich nicht für Anleger

- who are not prepared to accept increased volatility and temporary losses

- with a short-term investment horizon

- who seek safe returns

Monthly Commentary

The DJE - Gold & Resourcen gained 12.09% in March. The XAU gold mining index rose by 20.88% in USD terms and by 20.93% in EUR terms due to the appreciation of the US dollar. Gold mining shares thus outperformed the gold price. The fine ounce rose by 9.08% to USD 2,229.87 and by 9.02% to EUR 2,061.47. Including this development, gold rose by 8.1% in USD and 10.3% in EUR in the first quarter of 2024, reaching a new record high. Ongoing demand from central banks had a positive effect, particularly from China, where the People's Bank of China (PBOC) further expanded its gold purchases. Demand for jewellery has also picked up again in China since the beginning of the year, which is probably also due to the fact that investment alternatives such as the Chinese stock and property markets still do not appear particularly attractive for investments. Gold was also supported by statements from members of the US Federal Reserve that three interest rate cuts are still likely for the current year. Even if the timing and extent of the interest rate cuts are still uncertain, historically low interest rates have proven to be positive for the gold price. The weighting of gold mining stocks was over 47% in the reporting period and thus higher than in the previous month (over 43%); the focus remains on solidly financed producers that generate positive free cash flows even at lower gold prices and also have a certain growth perspective. Broader-based commodity/chemical stocks also performed positively in March, but generally worse than gold mining stocks: the MSCI World Materials rose by 7.01% and the CRB commodity index by 5.57% - both indices in EUR.